How to Trade Forex | Learn 6 Strategies and Tips

Discover the world of forex trading with our comprehensive guide. Learn essential strategies and risk management, tips, and gain expert insights to start your forex journey confidently. From beginners to experienced traders, find how to trade forex profitably and make informed trading decisions.

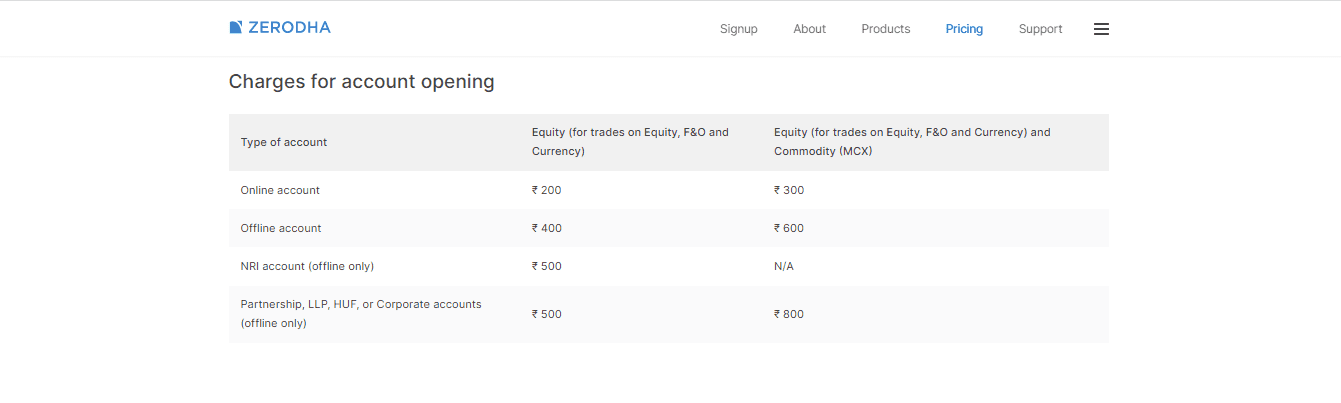

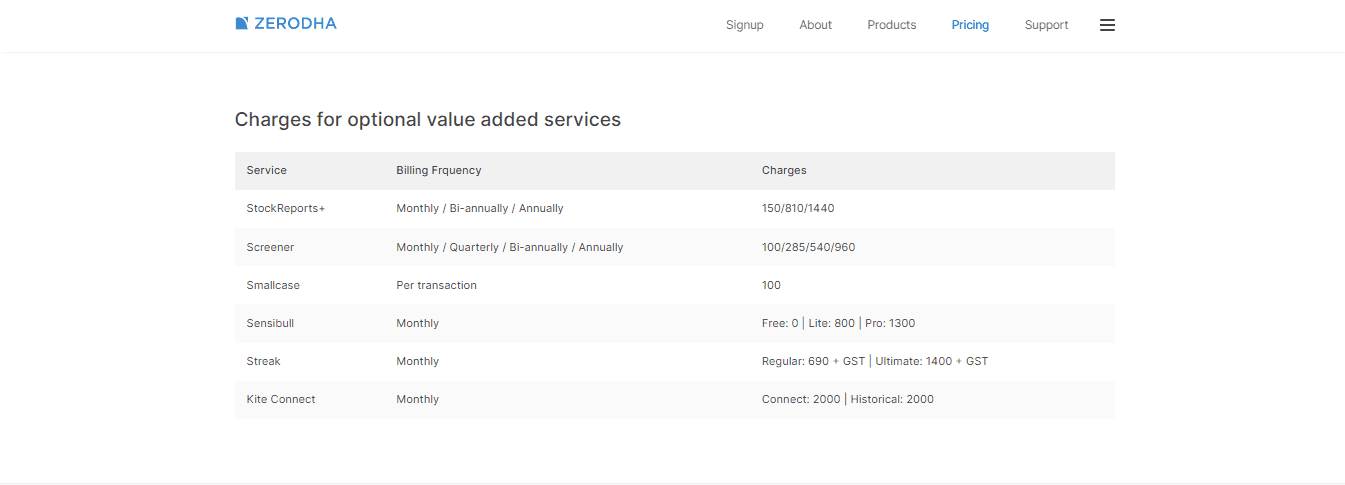

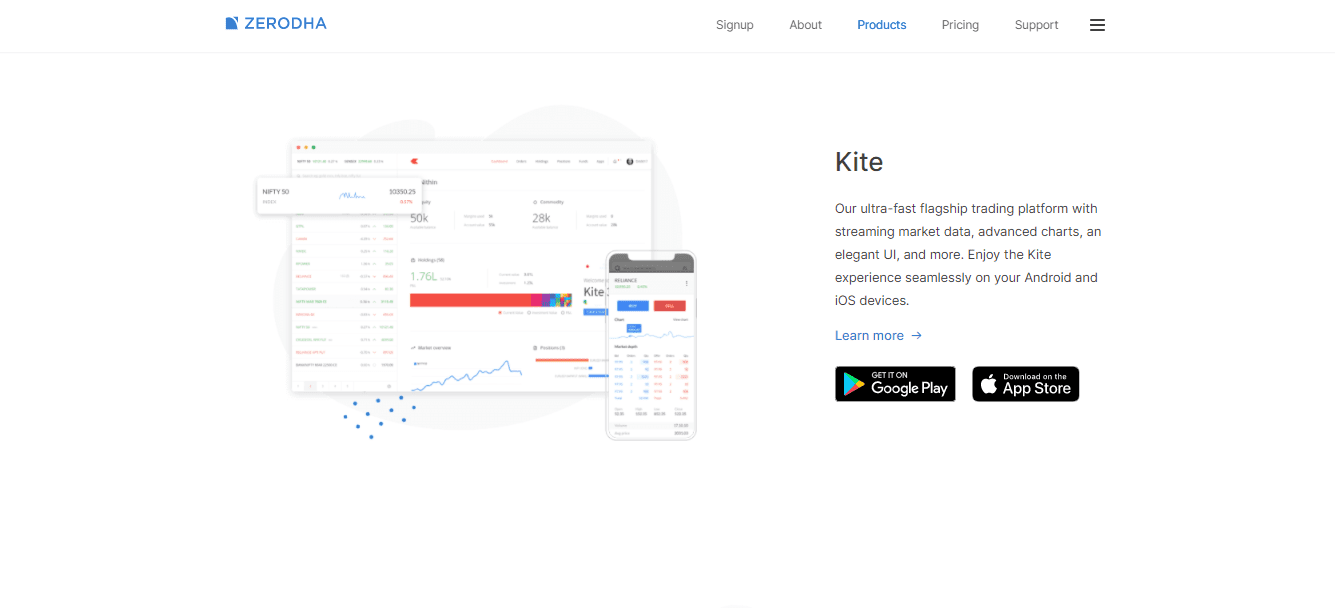

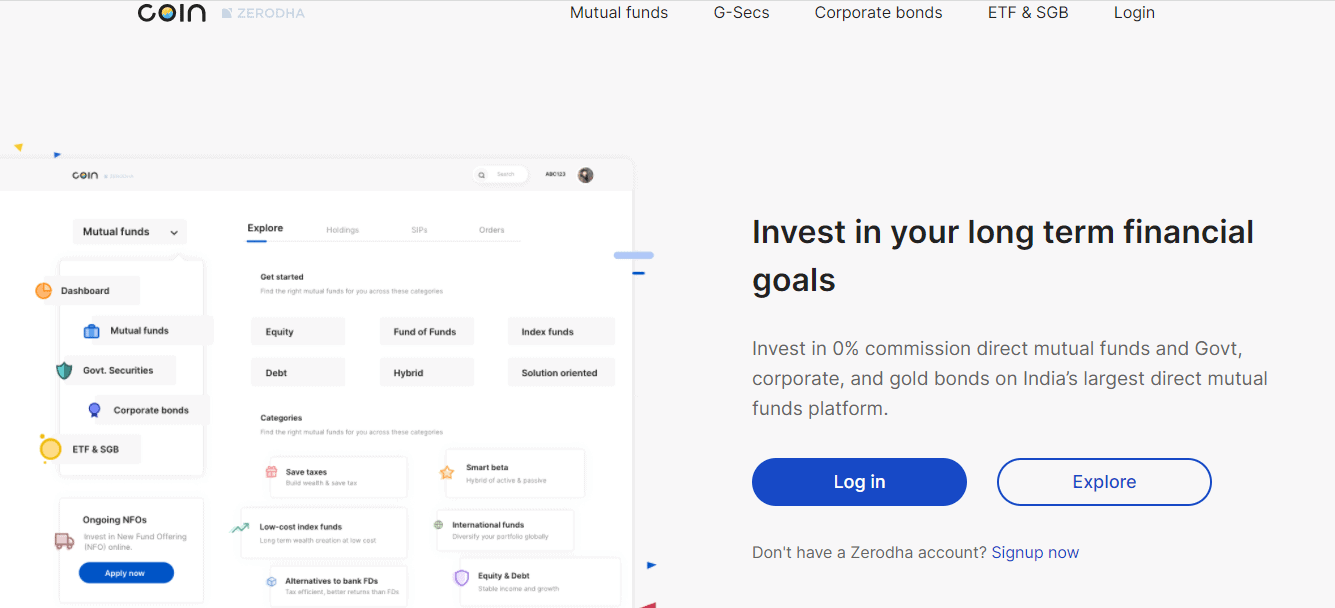

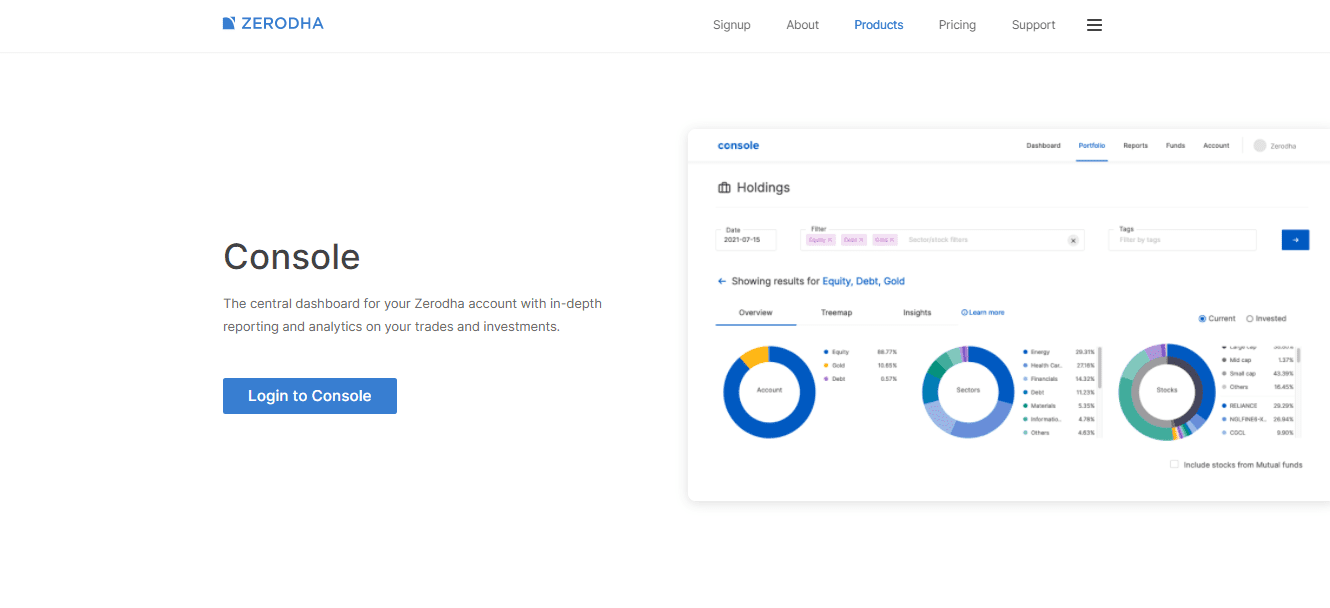

Zerodha Highlights

Zerodha Highlights

Awards

Awards Awarded By

Awarded By

Customer support of Zerodha

Customer support of Zerodha

Pros

Pros  Cons

Cons